The Mini Budget Wasn't So Mini, But Will You Be Quids In?

- The Penny Pincher Team

- Sep 23, 2022

- 5 min read

The Mini-Budget; What Does It Mean For You?

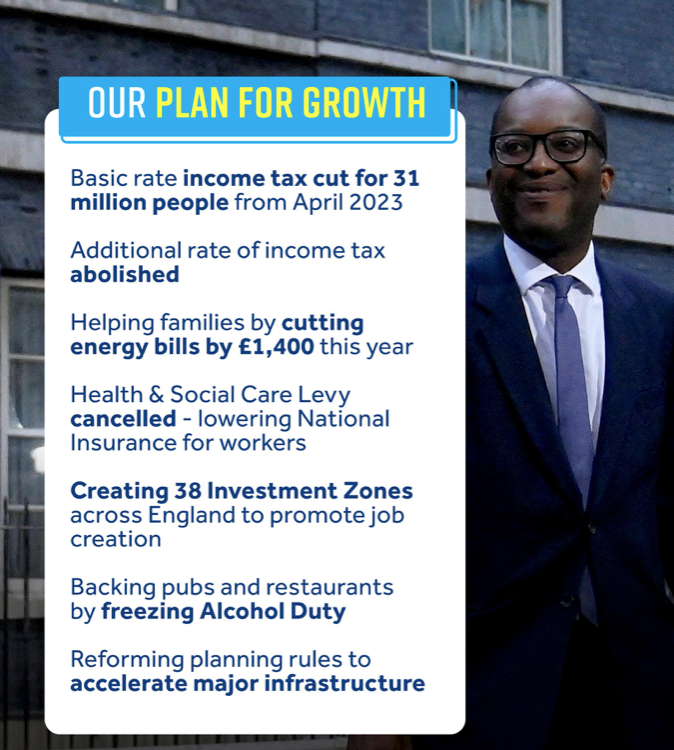

Kwasi Kwarteng this morning announced significant tax cuts - including a lowering of the top rate of income tax, a stamp duty cut and scrapping the corporation tax rise, but what does it mean for you, are you going to be much better off, and after yesterdays rise in interest rates, where those with a mortgage will be £25 per £100,000 of mortgage, (so £50 for a £200k mortgage and £75 for a £300k mortgage and so on), worse off, will any positive news from the mini-budget, be immediately wiped out?

My pick of the best of the mini-budget

• The basic income tax rate will be cut to 19p in the pound from April 2023. Will mean 31 million people will be better off by an average of £170 per year.

This is welcome, however, as the interest rate has just gone up, adding to bills, plus the price of food and, of course, the fuel going up on average £1,000 over last year, it's going to make little difference to most.

• The 45% higher income tax rate is to be abolished and reduced to 40%, so those with better-paying jobs will notice a difference in their paycheck, but it won't affect those earning less than £50,000 a year.

• It was already announced that April's National Insurance hike would be reversed from the 6th of November this year - saving money for businesses and 28 million workers. The 1.25 percentage points increase was introduced under former chancellor Rishi Sunak. The rise was to help fund extra NHS resources. However, the new government insisted that this additional funding would still be available and financed by extra-governmental borrowing.

• Sadly nothing, there was nothing new in this mini-budget for pensioners; they won't see much change in their purses unless the recent interest rate rise means they will be receiving a higher interest on any savings they may have, sadly those with no savings and a meagre income, will have gained nothing.

• Stamp duty to be cut immediately, meaning that as of now, no stamp duty will be payable on the first £250,000 of a property's value - twice the current amount allowed. The threshold for first-time buyers is to be increased from £300,000 to £425,000, helping those setting foot on the property ladder for the first time. The property value on which first-time buyers can claim relief will increase from £500,000 to £625,000.

• Household bills to be cut by an expected £1,000 this year with aid from the previously announced energy price guarantee and the continuation of the previously announced £400 grant, which will be paid at a rate of £66 a month, to your energy supplier, over Winter, to help households be able to afford their energy bills. Millions of the most vulnerable families will receive additional payments, taking their total savings this year to £2,200. The total cost of the energy package, including business support, over the next six months, is estimated at £60bn, although with heavily fluctuating energy prices, this may be more or could be less; the government are unable to be specific as energy prices change almost hourly, so predicting the cost over the next six months is impossible. This support cost will be borrowed; the government has stated that It is "entirely appropriate for the government to use our borrowing powers to fund temporary measures to support families and businesses". This is a similar funding solution made during the pandemic to pay for furlough and business support.

• The EU-inspired cap on bankers' bonuses is to be scrapped as part of efforts to "reaffirm" the UK's status as a financial services hub. "All the bonus cap did was to push up the basic salary to bankers or drive activity outside Europe", the chancellor said. The idea behind this is to try and encourage businesses to settle and trade in the UK, rather than the EU and further away. The thought is that if a worker is unlikely to see any result from extra hard work due to a cap on their bonuses, then they won't work as hard or, more importantly, be as inspired to be more innovative, which can boost company productivity and profits, giving the government more income from increased company taxation.

• Taxes for businesses in designated sites will be cut, with employers not having to pay NIC contributions for ten years to support investment, jobs and growth. The government is looking at areas where these designated sites can be located asap. The issue with this is that companies may spread out their operations to these areas to reduce costs, rather than actually increasing productivity and investment, whilst closing down parts of the business where they would have to pay more to trade.

• Universal Credit Claimants who earn less than the equivalent of 15 hours a week at the National Living Wage, which is around 120,000 people, will be required to meet regularly with their Work Coach and take active steps to increase their earnings or face having their benefits reduced. The government have taken some flack over this, as feedback suggests that the government are just trying to get 'lazy people' back to work rather than just claiming benefits; however, the government insist it's to try and fill job vacancies as the number of people in employment is at record highs, and there aren't enough workers currently to fill all the available roles. Personally, I think this may be down to Brexit and the decrease in the number of foreign workers who left the UK, who had, until that point, been a great way to fill vacancies!

This new scheme is a good way to try and weed out those claiming benefits fraudulently; however, most claimants are claiming legally and honestly!

• The planned rise in corporation tax to 25% next year is cancelled. "We will have the lowest rate of corporation tax in the G20. This will plough almost £19 billion a year back into the economy", Mr Kwarteng said in the House of Commons. The idea is that the lower tax rate will incentivise companies to bring their business to the UK, create more jobs, and bring more revenue to our shores. This may be true; however, the government haven't done anything to address the likes of Apple, Starbucks and Amazon, who, with massive revenues, pay only the smallest of taxes, which is, in my view, obscene and fixing this would be a better way to earn additional tax revenue, or by increasing the taxes on the energy companies who are millions of pounds of profit on the energy we are all currently struggling to afford!

• Planned duty rises on beer, cider, wine, and spirits have been cancelled, which will be a relief to both pubs and drink manufacturers/importers and everybody who enjoys a drink on a night out. With all the price increases and general negativity in 2022, I think we could all do with a drink, don't you?

Written by Al Baker - The Penny Pincher