Why Cashback Sites Are Worth The Hassle & Which Ones Should You Be Using..

- Apr 22, 2022

- 13 min read

I'm sure you are already aware of cashback apps and schemes, but if not, they are a way to receive a financial reward in exchange for making a purchase via a specific cashback provider when you buy goods or services.

Is it worth the hassle?

Damn straight it is! Think of it this way, if you went into a shop, selected some products, and went to the till to pay, and saw two tills open and available, but one of the sales assistants shouted to you that if you went to their till, rather than their colleagues, they would give you a 5% discount on your purchase, even though you were still buying from the same shop, and paying the same way as you would have done at the other till, how likely is it that you would say no? I guess that 99.9% of customers would say yes, and be pretty happy about the deal they just got, right?

Well, cashback services can be thought of in the same way. You're online and looking to buy something from your favourite retailer, but rather than going directly to the retailer, you click onto a cashback site first and search for the retailer, you find it on the site, and they are offering you a 5% cashback rate if you click a link, which will take you to the same retailer website you were going to go to anyway and make your purchase. You've just ordered from the same retailer you were about to order from anyway and earned 5% of the purchase cost, which you will receive and can spend however you want... Realistically it's a no brainer for 30 seconds of effort; who wouldn't take advantage of the deal?!

How does the cashback site make money?

Every time you use a cashback site to make a purchase, the cashback site will receive a commission from the retailer, and they share this with you! The more significant cashback sites work directly with the retailers to grab you exclusive deals and offers. In contrast, the smaller cashback companies use referral schemes and affiliate companies, which pay them a commission they share with you.

It's a relatively simple concept; the cashback sites earn their money through commissions earned from the retailers. The retailers get extra business from the cashback sites advertising the retailer's services, and you get a cut of the action as well!

I always wondered why retailers would want to pay a commission to a cashback site and you, but having spent a long time using cashback sites, I realised that I am a prime example of why retailers are in on the cashback action! Here is an example of what I mean. Let's say I wanted to buy something that's sold by lots of different retailers; let's say, for example, I want to buy a pair of Levis Jeans. Most retailers are likely to have these jeans at a pretty similar price (and you can check Google shopping to see who is the cheapest), so you might buy from your usual supplier; after all, why not? It's the same price, and you know the retailer, so all good, right? So what you might do instead is head on over to Cashback Angel, which is a free website, and also a handy Chrome extension that compares cashback rates, miles, points, rewards & vouchers from the leading cashback sites and apps and shows you which is the best deal, plus any special retailers discount codes as well, which is fab! Below is an example from this site for the retailer Boots:

Now chances are you will make your purchase from the best prices cashback supplier instead of buying from your normal retailer. You've saved money, and it's pretty likely that instead of buying from your favourite retailer, you purchased from one of its competitors, giving them the sale and allowing them to get future business from you potentially, which they wouldn't have got if you hadn't wanted cash back, so for them, it's good business sense, and money well spent!

So which cashback sites are the best ones to use?

The simple answer is that whichever site gives you the best cashback rate is the best cashback site to use at that point in time! I'm very disloyal, not in a to my partner kind of way, but to my cashback provider, my allegiance is to my wallet, and if you aren't helping to keep cash in my wallet, I'm going elsewhere!

For that reason, I have several cashback providers I tend to cycle through to find the best deal, and here they are, and in no particular order:

Quidco

An app and website-based cashback site offers competitive cashback on a range of goods and services and is one of the more prominent cashback services in the UK. It's free to join and offers a premium service, giving you a better cashback rate, more promotions, exclusive offers plus other benefits, and costs you £1 of your cashback earned each month. I like it removes pesky adverts from the site, which can be annoying!

You can earn cashback on physical goods services such as home and car insurance. It compares the cost facility on specific services, plus cashback on phone contracts, TV services, utilities and holidays and nights away, so an extensive range of cashback options. You earn your cashback in the 'conventional' cashback manner, so search for a retailer on the Quidco site or app, click the link to take you to the retailer and then earn cash back on purchases made.

You can also earn cashback by purchasing a gift card via the Quidco system.

There is also a separate Quidco owned app called ClickSnap, which will let you claim cashback on specific grocery offers from UK supermarkets.

Quidco is a decent cashback service and offers some strong offers, which can often sway me to them from its competitors.

You can sign up HERE for the service; using our referral link will earn you a £5 bonus when you earn £5 of cashback!

Karma Cashback

A relative newcomer to the UK cashback scene, but pretty solid! It doesn't have all the same features as many of the other cashback services, but that's because it doesn't work in the same way.

Karma Cashback is a gift card cashback site/app. By this, I mean that you don't earn your cashback in the conventional, click through to a retailer and earn your cashback manner (and this is good, and I will explain why in a minute); this particular retailer earns you cashback by buying a gift card for the retailer you want to buy from.

So how does this work? - Ok, so let's say you want to buy something from John Lewis - instead of clicking through to John Lewis to earn your cash back, you buy a John Lewis gift card from Karma Cashback instead, so as an example, you are buying a £50 kettle from John Lewis, you would purchase a £50 John Lewis gift card. You get the £50 gift card applied to your account, which can be spent online, or in a physical store, plus you then receive cashback on your gift card purchase from Karma Cashback, which immediately gets added to your Karma Cashback balance, which can then be used to buy something else or can be withdrawn to your bank. As it's immediate cashback, you don't have to wait weeks to get the cashback applied to your account; it's instant!

Now, as I said a second ago, this method is pretty ace, and here's why - Using the John Lewis example, you now have a £50 John Lewis gift card to spend, having already earned your cashback with Karma Cashback, and your £50 gift card is basically cash to use on the John Lewis website, so you can then use another cashback site to click through to John Lewis, in the conventional manner, use the gift card as the payment method, and boom, you just earned cashback AGAIN - so you got cashback twice for the same purchase, from two different cashback services... Nice right!?

Karma has frequent promotions to keep you engaged with it; recent promotions included 5% cashback on your supermarket shop for three months, spend over £100 on vouchers and get a free £25 John Lewis gift card, spend £100 and get a free £20 Just Eat gift card, sign up to the app and get a free £5 Costa gift card, sign up to the app and get a free £5 Sainsbury's gift card, and as I write this post, they are offering anyone who buys any gift card, of any denomination a free entry to win a VIP experience to see KPOP at Wembley. These offers can blow its competitors out of the water, as the offers are on top of the normal cashback deals!

It's my favourite cashback site, with over £50 of freebie offers in my wallet after just a couple of months of use! They are working with 22,000 retail outlets in the UK, with some big-name retailers partnering with them!

The only downside to this app is that you can't use a debit or credit card to pay for your gift cards; instead, you need to set them up as a payee for your bank and send the money directly to them to pay for your gift card, via bacs. The payment arrives typically in a few minutes, so it's not a significant issue, but it does mean that you can't pay for your gift card using a credit card. Other than that, it's a really good cashback system; you should, at the very least, set up a free account, and download the app, to keep up to date with the latest offers!

You can sign up HERE for the service; they don't currently offer a referral service.

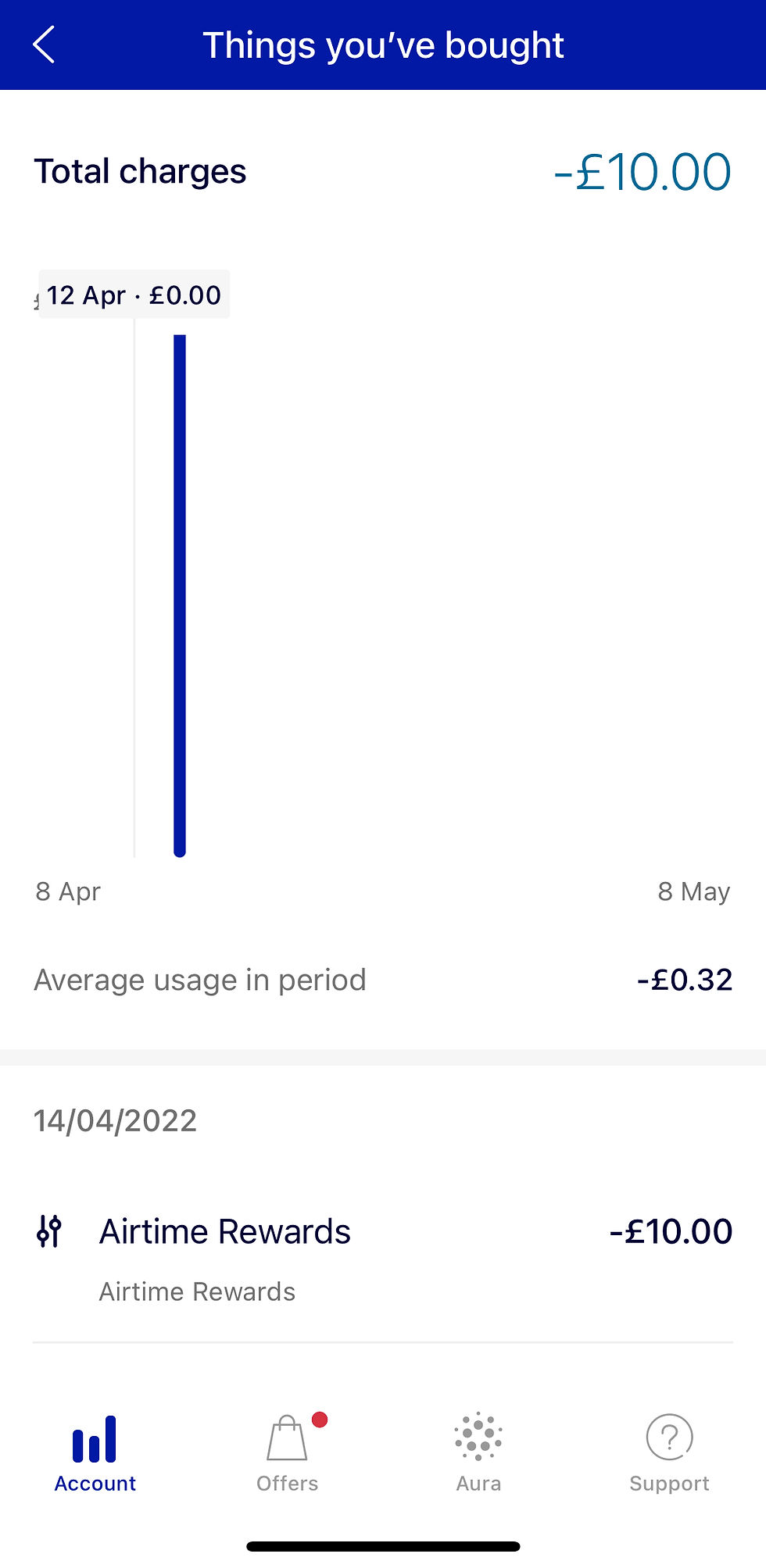

Airtime Rewards

Airtime Rewards is another of the more unique cashback services! This service offers cashback from many UK retailers, available in your cashback account balance once cleared. Once you hit £10 of payable cashback, you can withdraw the £10.

The withdrawal process is slightly different; rather than withdrawing the cashback to your bank, the app sends the cashback as a payment on your mobile phone bill, reducing your next bill down! This is the 'Airtime' part of the Airtime Rewards name!

It's a simple enough process to get your cash back, and in fact, it's probably one of the easiest ways to earn cashback! This is due to the way the cashback service is set up.

Once you have registered with the service, you add all your debit and credit cards to the app (yes, this is safe, I wouldn't recommend this app if I didn't have the utmost trust in it!), and then every time you spend at a retailer that's partnered with Airtime Rewards and pay using one of the debit/credit cards you have registered on the app, Airtime Rewards will detect the purchase and automatically apply the cashback to your account, so it runs in the background, so you need do nothing, other than checking the app from time to time, to see if you have cashback to withdraw to your phone bill, so it's hassle-free!

I seem to earn around £100 a year using this app, and recently I seem to be buying from more of the retail app partners; and have found that for the last few months, I've had £10 available every month to withdraw, which is super helpful being that I changed tariff recently, to a sim card only offer, which costs me £10 a month. So the £10 monthly withdrawal has meant I'm paying zero for my mobile phone contract every month, which is pretty amazing!

With over 300 brands partnered with the cashback service, you will find a retailer to earn from! The app isn't compatible with every mobile phone carrier in the UK; if you find your carrier isn't compatible, contact their customer services, as I'm aware of several people who spoke to them and now receive Amazon vouchers instead of phone credit, so well worth talking to them.

You will find monthly promotions, offering you bonuses when you spend X number of times at its retailers, and other bonus events that pop up out of nowhere, all of a sudden!

You can sign up HERE for the service, and if you use our referral code of Q8FWLDQB, you'll get a 50p welcome bonus and another £1 if you spend at a retail partner within seven days.

TopCashback

TopCashback is the most extensive cashback service in the UK, possibly the world, as they have a site in the UK, USA, and India!

TopCashback has over 4,400 retailers on its service, meaning it's pretty rare not to find cashback available from the retailer you want to purchase from; I find it's the smaller, more independent retailers that aren't offering the cashback to its customers the more significant the retailer, the more likely you will discover cashback opportunities!

That said, the likes of Amazon only offer cashback for its own devices, such as Alexa products, and to be able to grab Amazon cashback, you would need to use Karma Cashback or use the Top Gift Cards section of TopCashback, to buy a gift card for Amazon, to earn any cashback.

So back to TopCashback, which is the market leader, and for that reason, it often has to fight with rivals such as Quidco to offer the best cashback deals, so it can offer some cracking deals and stay at the top!

There is the standard/basic membership, which is free and offers competitive cashback, and then also has a premium service, which costs £5 per year (which it takes from your cashback balance annually), and this offers a higher rate of cashback, plus special offers and payout bonuses.

You can withdraw your cleared cashback to your Paypal account or bank account, but depending if you have a specific plan when withdrawing the cashback, you can also withdraw the cashback to a reward wallet. Once you have done this, you can then get a bonus by withdrawing your earnings to a gift card, which you can then use at your favourite retailer, (I tend to withdraw my earnings as supermarket vouchers, as it helps with the food budget!), and make sense as you can get up to a 25% bonus, (my supermarket bonus is 4%, 25% is generally for a more obscure brand!), which can't be sniffed at!

You can, in a similar way to Quidco, earn cashback on goods and services, as well as a Snap & Save facility, which is infrequent but offers you cash back on items purchased in a supermarket, such as £1.50 back on a pumpkin at Halloween, £1.50 back on an Easter Egg at Easter, which is free so worth doing!

Keep your eye out for special competitions and promotions, with popular Christmas and Halloween promotions, where you can earn cash prizes, having a big following, with whole Facebook groups set up dedicated to help give you advice on where to find clues and answers to riddles!

Keep your eye out for their 'Global Bonus' events, where they will offer a one day bonus when you spend a certain amount via their site /app. Usually, this is a spend £5 and get a £2 bonus type promotion. If you don't need to buy anything, purchase a £5 supermarket gift card, as this will give you cash back on the £5 gift card as well as the £2 bonus, so your £ then turns into £7.30 ish, which isn't to be sniffed at... I always take advantage, as free money is free money!

There is also a free cashback section on the site/app where you can grab free cashback for signing up for competitions and survey sites, downloading apps, registering on gambling sites, comparing insurance prices and similar, which can be rewarding; I know I made £55, (well £45 actually, after losing the tenner), on a gambling site by registering, wagering, and losing £10, but got £55 added to my TopCashback account, which was pretty easy and profitable!

The Top Gift Card section of the site works similarly to Karma Cashback, where you can purchase gift cards for use at retailers and earn cashback on the purchase. (although I found Karma Cashback to offer slightly better rates generally), and like Karma, the cashback on the gift cards is instant.

Like most cashback sites, the system has browser extensions you can install that will notify you of cashback rates and deals while you are browsing, which is helpful as it can be easy to forget about cashback while browsing and getting into the buying zone! Use these as a reminder to get cashback, but also remember to use something like Cashback Angel to make sure you are getting the best cashback rate, especially for more expensive orders!

You can sign up HERE for the service; using our referral link will earn you a £10 bonus when you earn £10 of cashback!

I've earned very nearly £1500 cashback via TopCashback alone! It just shows that it's not that hard to earn cashback! The beauty of cashback is making money by spending money you would spend anyway! Be savvy and think outside the box!

For example, if you know you will spend £200 a month at your local supermarket, buy £200 of gift cards for the supermarket when you get paid, you still have the £200 to spend (they don't expire for years) but also earned cashback on the £200 as well, and that could be an extra £8, which over a year is £96, all for spending 2 minutes a month grabbing the cashback!

Other cashback sites well worth a mention are:

Kindred - Website and browser extension offering competitive cashback as well as a donation to a charity of your choice

Honey - A really helpful browser extension (owned by PayPal) that automatically applies discount codes to your shopping cart to try and save you money on your purchase. If not successful, it will offer you cash back if the retailer is one of its partners. The discount coupons part is super helpful and has saved me several hundred pounds in the year, or so I've been using it, so worth the free install!

Kids Pass - Even though it's not strictly a cashback service, Kids Pass offers loads of discounts on some big-name brands and exclusive offers. I saved nearly £7 on two cinema tickets plus got two free drinks included, with some pretty decent deals on days out available. There is a £4.99 monthly charge (£1 trial for 30 days you can cancel to get no further charges) for the service, but it's straightforward to earn that £4.99 back if you like to go to the cinema or take kids to restaurants and day trips etc.

Jam Doughnut - Another app offering competitive cashback rates for its customers. Cashback is more or less instant, so not waiting around for it to clear, and works similarly to Karma Cashback, where you buy a gift card in advance of purchasing. Referral code TP51 gets you a welcome bonus. Swapi - A cashback app I recently discovered but think is pretty great! You add your store loyalty cards to the app, and then every time you scan the loyalty card, in-store or online, via the Swapi app, you earn points that can be converted to gift cards when you have enough. You can also earn points by shopping via the Swapi app, grabbing points for online spending from its extensive list of UK retailers. The app also offers special marketplace deals and discounts, making the app pretty rewarding. The app also gives out points on expired loyalty card points that you can no longer redeem with the retailer, with Morrisons being a good example, as points from their old loyalty system are still being accepted by Swapi and converted into Swapi points, so if you didn't manage to cash out your old Morrisons points before it changed to the new system, you could still get something for them! You can use our referral LINK to get 50 free points to get you started.

Whatever you do, make sure you grab as much cashback on your purchases; the savings really add up!