Stay Ahead of Insurance Renewals With This Fab Free Service - I Saved £70!

- Jul 4, 2023

- 4 min read

Game-Changing Way To Keep On Track Of Your Insurance Policies & Avoid Auto-Renewal!

I recently changed my vehicle, and so I needed to contact my insurance company to get the car insurance policy swapped over; a simple enough task, you'd think; however, I realised I had no idea who my insurance company was!

I know that sounds random, but I use comparison sites to find the best price on my insurance when my renewal time hits, and I always seem to end up with a company I've never heard of, which is fine as long as I'm covered for the possible price, I'm happy; however, this is an issue when I need to contact them!

I searched my bank account for a clue as to who I'm paying every month, but this didn't tell me enough to figure out which company I'm with, so I resorted to manually going through my emails until I found the company, and it took flipping ages! It wasn't a fun experience, but I got there!

Imagine my frustration when the very next day, I found out about Rightly Save, which would have saved me all the frustration!

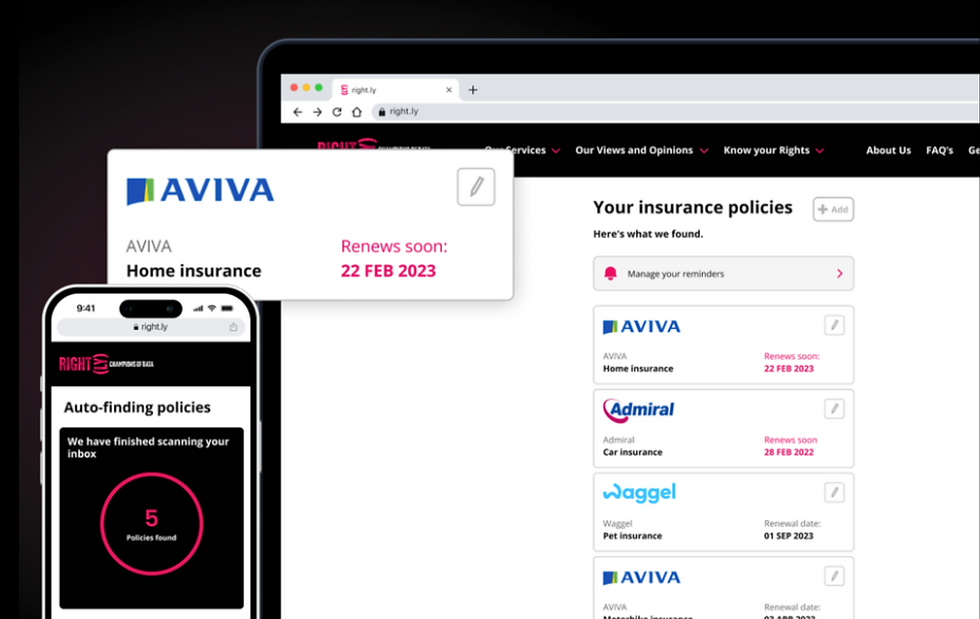

Rightly Save is a free service which scans your emails and finds all your insurance policy emails, and shows you a list of what policies you have and when they are up for renewal. Not only that, they'll also email you 30 days and 15 days before your renewal date to remind you that your policy is coming to an end and give you time to search to find the best price and, importantly, avoid your policy auto-renewing, which may well not be the best price available for you!

How Does It Work & Is It safe?

To use this service, go to the website, and you'll be asked to give permission and give your email details so the service can access your emails online and scan for policies. This is totally safe, they can't access your emails to read, nor can they send emails etc; it simply scans your email box to look for emails from insurers. You can remove the permissions at any time. No emails are kept, and policy results are encrypted. The system won't be able to see your policy number, only that you have a policy and when it ends.

Now I know that people can be wary about letting a service or someone else have access to their personal data or emails, and that's quite understandable; it crossed my mind when I first heard about the service; after all, nobody wants an external company/person to be able to record all the details on your emails; however, genuine websites and apps are not able to do that, even if they wanted to; there are a series of protocols in place that means you can log in into a website service confident in the knowledge that your details will not be captured.

This sort of technology is used by many websites and apps these days; I know I use lots of services where I have to log in via my Google account or Facebook, and these all use the same technology; they only have access to specific pieces of information, and can't see passwords, usernames and other confidential pieces of information.

This service will simply scan your email folder for insurance policies and will advise you of who the policy is with and when it ends, but it won't be able to read any emails or personal information, it's safe to use! There is a dedicated help page on Rightly's blog which explains exactly how the security system works, which is very useful and interesting, and of course, reassuring!

Does it work?

I tried the service out, and it found that policy I was looking for in 30 seconds, PLUS 3 other policies I'm paying for as well, one of which I had forgotten about and as the monthly cost was only £5.99, I had missed it on my bank statement, so I've now cancelled that and I'm £71.88 better off a year as a result!

The service will detect all your insurance policies that are registered to your email address over the past thirteen months, not just motor vehicle insurance, and so it gives you lots of notice on your policy renewal dates, giving you the opportunity to make savings on all your policies!

The service isn't a comparison site; it's not going to try and sell you a policy; it's a simple-to-use policy renewal reminder service!

The system currently works with Microsoft and Google email clients, so popular email services such as Gmail, Hotmail, Live, Outlook & MSN, with more email clients to be added in the future.

Once the scan is complete, it will show you a list of your new policies, plus existing policies and your renewal dates, and you can see what you have and when they end. It's a great way to save consumers valuable time, money, and stress by alleviating the burden of tracking policy renewal dates and preventing auto-renewal when better deals are available through comparison shopping.

It's a good idea to try the free service out and check to see what policies you have, just in case, like me, you find something you don't need or want anymore that's just been ticking along in the background and costing you money, plus you'll also then get renewal reminders, which could save you a decent amount of money and simplify the renewal process for you!

You can try this service out for free HERE I wish I had earlier, before wasting so much time looking for my policy, but better late than never; I'm chuffed I did to have already saved over £70 and get reminders to look for extra savings in the future, which I've already received for my other vehicle, which was really useful as I had the insurance down as ending at the end of the month, and it actually ended at the start of the month; without that email coming in to remind me that my insurance was about to end, I genuinely wouldn't have noticed and would have likely been driving without insurance, which is never recommended!